Are You Leaving Money On The Tax Table?

/By Shelley Murasko

It’s tax season! As you work to finish your return, did you know you might be missing out on valuable tax breaks that could save you thousands of dollars?

In fact, a tax break could save you up to 50% of the deduction if you live in a high-income household. This is a result of the high tax brackets that top incomes can hit — 47% or higher in California — as well as the valuable credits and deductions that can be phased out.

Therefore, it’s well worth your time each year to maximize all possible tax breaks. Check out the list below of nine proven tax break opportunities that are often overlooked. Then consider which ones might be right for you. Just be sure to consult with your tax professional before implementing the following concepts as unique circumstances often apply.

1 – Accumulate Money in a Health Savings Account (HAS)

For working professionals, the HSA is the most misunderstood tax shelter. Interestingly, it ranks as one of the best ones out there. Why? It’s the only tax-friendly account that gives a tax deduction going into the account AND when the money comes out for use with health expenses.

When enrolled in an eligible high-deductible, health savings plan in 2022, you can contribute $3,650 as a single filer or $7,300 as a family. If you’re 55 and over, you can also make a $1,000 catch-up contribution.

Ideally, you’ll accumulate money in an HSA and let it build for retirement where it can then be used for Medicare premiums. Along the way, you can access it at any age for medical expenses, from sunscreen purchases to out-of-pocket doctor fees. In the event of a large expense, such as braces or a visit to the emergency room, you can tap your HSA to offset the financial challenge of these one-time expenses.

Most people mistakenly believe they must use up their account balance before the end of each year. While this is true of a Healthcare Federal Spending Account (FSA), it’s not the case with an HSA. Your money remains in your account until you’re ready to use it.

Another misnomer is that you can’t invest the funds that are in your HSA. In most cases, HSAs allow for an investing option once you have at least $2,000 in your account.

2 ‑ Maximize Your 401(k) or 403(b) at Work

Many of my clients truly believe they are maximizing their 401(k). After reviewing their accounts, however, I often find this is not actually true. Here are a few tips for rectifying this.

If you’re under 50, you can contribute up to $20,500 into your 401(k) in 2022. This is in addition to the allowed employer match. If your employer gives you a $5,000 employer match, for instance, you can contribute an additional $20,500 for a total of $25,500. On top of that, you can bump this up in the year you turn 50 with a “catch-up” contribution of $6,500.

3 ‑ Choose a Roth 401(k) Over a Traditional 401(k)

The share of 401(k) plans offering a Roth savings option grew to 86% in 2020. This is up from 75% in 2019 and 49% a decade ago, according to the Plan Sponsor Council of America.1

The Roth 401(k) popularity does not mean it’s right for everyone, though. It’s best to work with a tax professional to determine if your tax bracket is lower now than it will be in retirement. If it clearly is lower now, then a Roth 401(k) contribution makes sense. If not, stick to the traditional 401(k) option.

Not sure which way the tax bracket will go for you in retirement, even after working with a CPA? Consider tax diversification where you divert half your contribution to the Roth 401(k) and half to the traditional 401(k).

4 – Make a Backdoor Roth Conversion

Ever heard of a backdoor Roth Conversion? This is a Roth IRA contribution that was originally added to a traditional IRA without deduction and then moved into the Roth. A backdoor Roth IRA is a legal way to get around the income limits that normally prevent high earners from owning Roth accounts.

When a regular IRA contribution is not deducted from income due to income limits, a smart move is to convert it to a Roth IRA before the contribution is invested. Since the money went into the traditional IRA after-tax, it’s allowed to be converted tax-free.

This tax opportunity has been getting some headlines lately as Congress debates on whether to remove this option. I hope they don’t as it’s one of the few ways that higher income individuals can smartly get savings into a Roth IRA.

The Backdoor Roth IRA conversion works best when there are no other assets in IRA accounts. If there are, then you will be subject to the “pro-rata rule.” It specifies how the IRS will treat pre-tax and after-tax contributions when you carry out a Roth conversion. Before proceeding, speak with your tax professional to understand your best option.

5 – Set Up a 529 College Savings Plan

Before you know it, your kids, or perhaps your grandkids, will be closing in on the college years. Hopefully you’ll be ready with ample college savings to get them off to a great start! Along the way, you can save some serious tax dollars by growing those college savings in a tax deferred 529 account.

According to Morningstar, the top 529 plans over the past decade include:

· Utah: Utah Educational Savings Plan (UESP) at my529.org

· Michigan: Michigan Education Savings Program (MESP) at misaves.com

· Illinois: Bright Start 529 Plan at brightstart.com

The 529 plan you choose has nothing to do with the state where your child will attend college. However, in certain states you might earn an even higher deduction by using their state plan. Check with your state to understand their incentives. Also, while 529 savings must be used for college costs to avoid the 10% penalty, the savings can be transferred to alternate beneficiaries who are related to the current one. This built-in flexibility makes these plans a great way to pass on a legacy.

6 ‑ Use Tax-efficient Index Funds In Your Taxable Accounts

A capital gains distribution is a payment made by a mutual fund. This includes a portion of the proceeds from sales of the fund's stocks and other assets from within its portfolio. It’s the investor's pro-rata share of the proceeds from the fund's transactions.

You can find the capital gains distribution on your 1099 tax form from your taxable investment account under the dividend section.

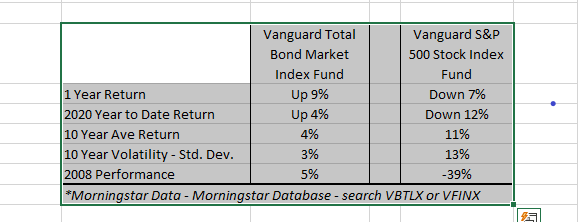

Some capital gains are necessary, especially in a year like 2021 that recorded strong stock market performance. Yet you might find the distributions from actively-managed funds to be excessive relative to a low-cost, passively-managed, better-performing index fund.

This is just one more reason why low-cost index funds can make good sense in your investment portfolio.

7 ‑ Take Advantage of Qualified Charitable Distributions

Once you are age 70½, the IRS allows you to distribute up to $100,000 from your IRA tax-free that would normally be a taxable distribution. In addition, this distribution can count toward your Required Minimum Distribution (RMD).

Since there are not many ways to get money tax-free out of your traditional IRA, you might find this to be an appealing way to do so.

8 ‑ Give Money Through Donor-Advised Funds

The U.S. government wants you to give to charity. Thus, they offer many ways to donate your wealth while saving on taxes.

One of the most convenient ways to give to charity as tax-efficiently as possible is to open a donor-advised fund. You can give a lump sum to a dedicated charity account in one year to claim the tax deduction. Then you can distribute the charitable gifts out over several years.

In a year where you have a lump sum of income from a sale of property or inheritance, you might find the donor-advised fund most useful for bringing your income down to a more reasonable level.

Clients also find it interesting that they can give an appreciated stock to a donor-advised fund. Check with your tax professional as income limits do apply.

9 ‑ Make the Most of Roth IRA Conversions

In a low-income year — perhaps you lose your job or retire early — it’s worthwhile to study whether converting your traditional IRA to a Roth IRA could make sense for your taxable future.

Although you still pay taxes on the amount converted, you avoid paying taxes on that same income in a future year when you are in a much higher bracket.

Albert Einstein once said, “The hardest thing in the world to understand is the income tax." When he said that, our tax code was likely much simpler than it is today. While paying taxes is a necessary part of being an adult, taking advantage of tax breaks may ease the burden.

Have questions or concerns? Give us a call or send us an email. We’re here to help!

Wealthrise Financial Planning is an investment advisor registered with FINRA. This material is provided for informational and educational purposes only. Please consult your tax professional on all tax-related matters.

Sources:

1. Iacurci, Greg. (Dec. 27, 2021). CNBC. "Employers adding Roth 401(k) option at fast clip.” Retrieved from https://www.cnbc.com/2021/12/27/roth-401k-availability-grows-rapidly.html