Love the Bonds You're With

/Enough about stocks already! I’m sure we’re all sick of hearing about when or if they’ll recover. The headlines are flooded with useless predictions and analysis. Every. Single. Hour. The reality is this: Yes, they will eventually recover. Now, let’s move along.

It’s times like these when the bonds in your life should take center stage, especially if you’re retired or within a few years of retiring.

(Note: The word “bonds” will be used throughout this piece, but please note that for the sake of this discussion, it is interchangeable with the term “bond mutual funds,” which are funds that own thousands of bonds.)

Definition of a Bond

As a reminder, what is a bond? A bond is a loan. When you invest in a bond, you’re simply lending money to another entity. For example, a 2.2% interest – 10-year, U.S. Treasury bond is a loan that you make to the U.S. government that returns 2.2% annual interest until the loan matures after 10 years. At the end of that timeframe, you get your original investment back.

Because there’s an implicit IOU involved with bonds, they offer more certainty of return than stocks.

With stocks, you’re part owner of a company. Therefore, you might get profits and, then again, you might not!

Bond Performance in Bear Markets

Bonds, when done right, are the key to peace of mind and cash flow assurance during volatile times. Why? Despite the fact that they, too, have their own risks like interest rate or default risk, they should be the primary investment category in your portfolio that most likely gives you positive, stable return during bear markets.

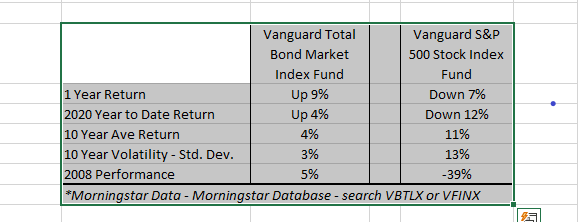

For example, compare the Vanguard Total Bond Market Index Fund (VBTLX) to the Vanguard S&P 500 Index fund (VFINX) below.

Since January, you might note that the bond fund is up 4% over the past few months compared to stocks, which are down 12%. You might also notice that the bond fund has only offered an average of 4% return over the past 10 years compared to the stock fund return at 11%.

These two funds demonstrate how we expect bonds to behave relative to stocks. Under normal, mostly positive, stock market return years, bonds don’t offer as much return as stocks. When a bear market comes along like the one we’re in now, bonds provide a shelter from the storm.

Not All Bonds Are the Same

During rocky times, the true colors of our bond holdings come out. What I mean by that is not all bonds are going to perform defensively. Investment-grade bonds play solid defense while high-yield bonds, aka “junk” bonds, fail to do so.

How can you tell which is which? By understanding the characteristics of each. To do that, you need to be aware of the two most important bond traits: Credit Quality and Duration.

Credit Quality is just like it sounds: How good is the credit of the entity you’re lending to? Are you lending to your 22-year-old, unemployed nephew or your gainfully employed, 55 year old uncle? When it comes to the bonds you’re counting on to use during bear markets, you’ve got to stick to lending to your financially stable uncle, even if he’s not willing to pay you as much interest.

As a real-world example of this, if you had looked up bonds to invest in a month ago, you would have found high-quality U.S. Treasury bonds at 2% and low-quality Western Digital corporate bonds paying 4%. As tempting as it would be to go with Western Digital at a higher interest rate for bear market protection, the sensible investor would stick to the Treasury bonds and other investment-grade bonds, which are bonds rated at high to intermediate quality.

Back in the 1980s, high-yielding bonds like Western Digital were actually called junk bonds. To this day, within the industry, funds holding low-rated corporates are considered junk. They may have gotten this name because they’re not very useful: not great at playing offense (they average about 3-5% less return than U.S. stocks) and not very good at playing defense (they sink like a box of rocks during bear markets).

So how is Credit Quality determined? It’s measured with ratings of third-party agencies like Standard & Poor’s and Moody’s. While these agencies are far from infallible, they do a pretty good job of supplying investment-grade bond fund managers with the information they need to stay clear of junk.

Duration, the other bond trait you need to know, is a measure of a bond’s sensitivity to interest rate changes. It’s measured in years. A shorter duration is less sensitive to interest rate risk than a long duration. The Treasury bond paying 2% over 30 years, for instance, might not be a bond you want to keep if bond interest rates rise substantially in the near term.

In general, you should stick with short to intermediate term duration bonds, normally with terms less than 10 years, that will be less impacted by interest rate changes.

What Matters About Bonds Now

If you’re retired or nearing retirement, it’s important to assess where you currently stand with your financial holdings.

Start by calculating how much money you’re currently holding in bonds, bond funds, money markets, CDs and cash. Verify that your bonds are investment-grade.

Then take that total and divide it by the amount of cash you expect to need each year from your investments. This simple math will give you an idea of how many years you have covered with your defensive money.

No one knows when the stock market will recover, but if you have enough defensive money, your bonds and cash will give you the confidence to stay the course. If your defensive holdings will cover you for at least five years, you can sit back, take a sip of your “quarantini” or other beverage of choice, and know that your bonds are supporting you during these rocky times.

Past performance is no guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Investing involves risks. Wealthrise Financial Planning is an investment advisor registered with FINRA. This material is provided for informational and educational purposes only. It should not be considered investment advice or an offer to buy or sell securities.